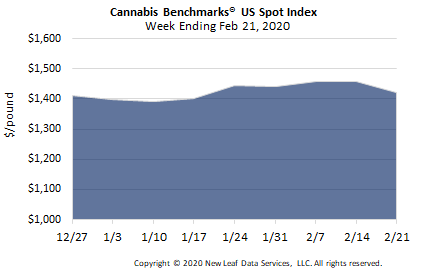

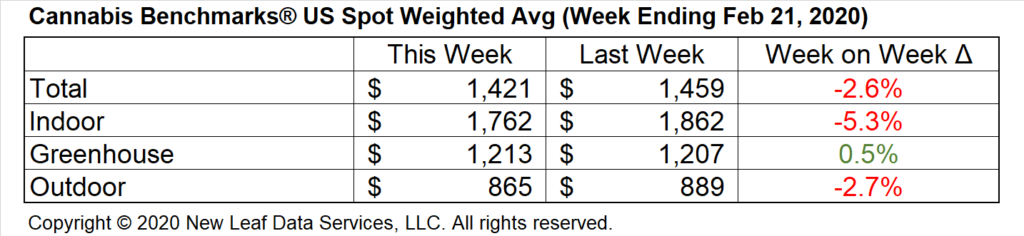

U.S. Cannabis Spot Index down 2.6% to $1,421 per pound.

The simple average (non-volume weighted) price decreased $2 to $1,685 per pound, with 68% of transactions (one standard deviation) in the $929 to $2,442 per pound range. The average reported deal size increased to 2.3 pounds. In grams, the Spot price was $3.13 and the simple average price was $3.72.

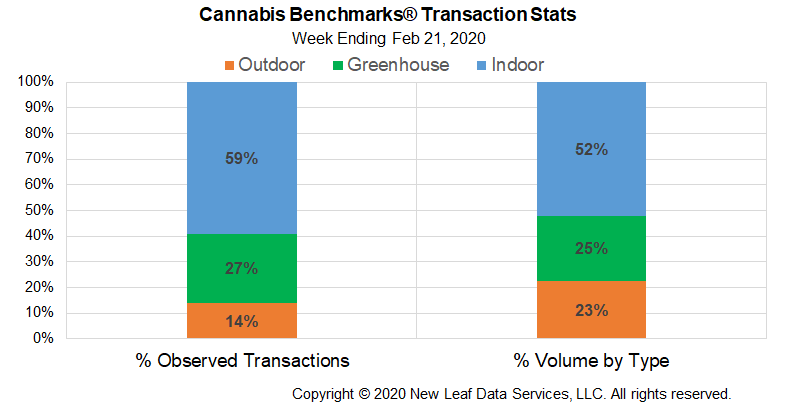

The relative frequency of trades for indoor flower increased by 3% this week. The relative frequencies of deals for greenhouse and outdoor product decreased by 1% and 2%, respectively.

Greenhouse product’s share of the total reported weight moved nationally contracted by 4% this week. The relative volumes of warehouse and outdoor flower expanded by 3% and 1%, respectively.

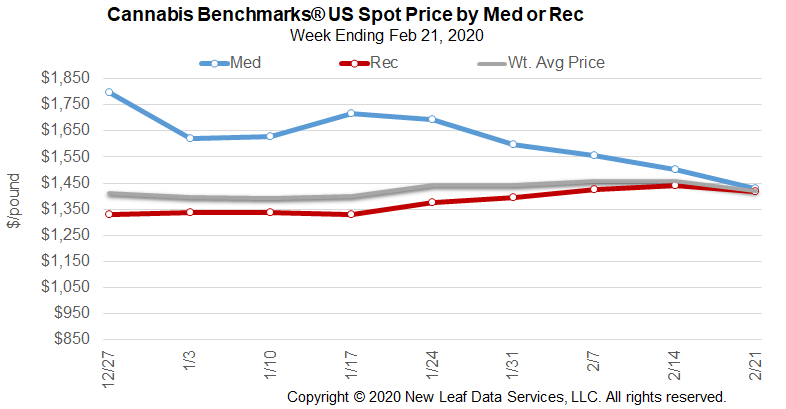

The U.S. Spot Index declined by 2.6% this week to settle at $1,421 per pound. The trend lines of the Spot Indices of each of the country’s four largest markets are all on the downswing for the first time since early 2019. In the West Coast states, the overall declines in wholesale flower pricing are due primarily to falling rates for outdoor product. Such flower saw both its national relative volume and average deal size grow this week, indicating that additional amounts of last year’s autumn crop are coming to market.

We have pointed out in prior reports that historical sales data shows the first two months of any given year are generally a period of lower demand relative to March, when sales have been observed to spike in numerous adult-use markets, as well as medical ones in some cases. Retailers preparing for increased sales in the coming spring season may be bringing in lower-priced outdoor flower as inventory in order to help boost margins. Wholesale prices for such product indicate that supply is ample; this week’s volume-weighted rate for outdoor flower is off by 20.3% from the opening week of this year.

In addition to falling prices in the four largest markets, the states with the newest adult-use systems – Massachusetts, Michigan, and Illinois – have also seen wholesale flower rates subside in recent weeks. Prior to that, climbing prices in those states provided some upward pressure on the U.S. Spot.

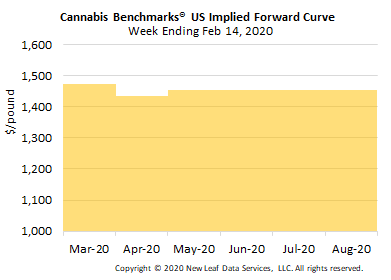

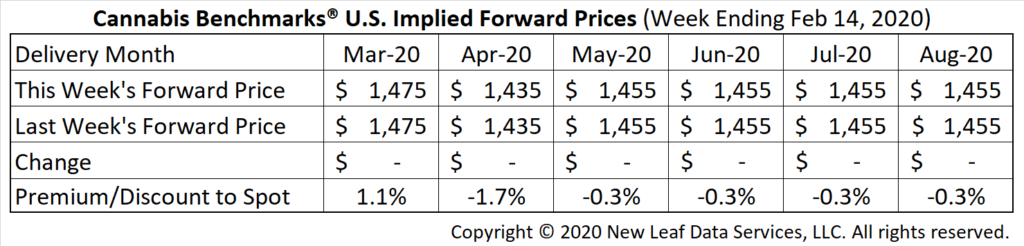

March Forward unchanged at $1,475 per pound.

The average reported forward deal size was 41 pounds. The proportion of forward deals for outdoor, greenhouse, and indoor-grown flower was 49%, 34%, and 17% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 46 pounds, 34 pounds, and 39 pounds, respectively.

At $1,475 per pound, the March Forward represents a premium of 3.8% relative to the current U.S. Spot Price of $1,421 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Headlines From This Week’s Premium Report:

California

Revised Definition of “Wholesale Cost” Could Lower Tax Burdens of Retailers in Some Cases

Colorado

Flower Production Up, but Demand Down YoY in H1 2019; Consumers Turned Increasingly to Concentrates and Edibles in First Half of Last Year

Oregon

Retail Sales Down Slightly in January, but Largely Stable at About $67.5 Million, as Monthly Harvest Volume Up Around 20% YoY

Michigan

Medical Cannabis Sales Rise 1.4% in January to $25.2 Million; Adult-Use Retail Revenue Up 41% MoM to $9.8 Million