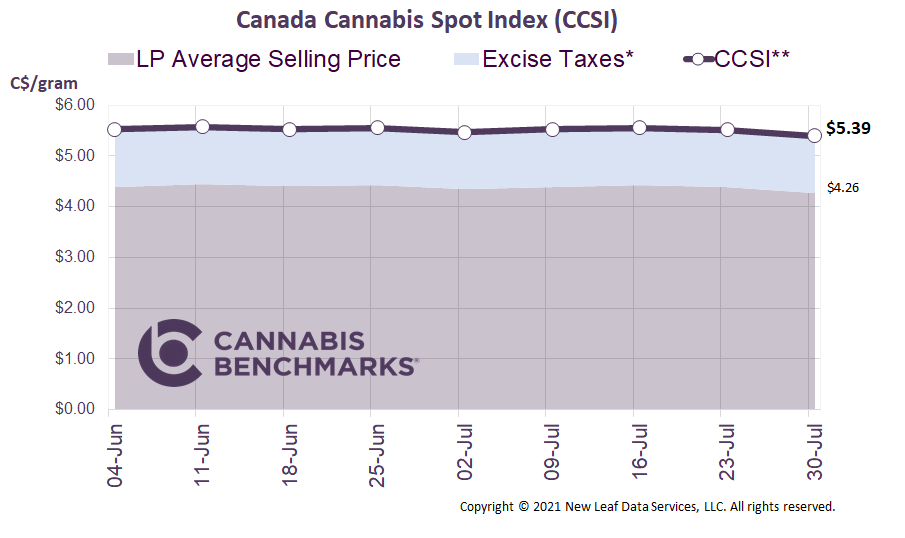

Canada Cannabis Spot Index (CCSI)

Week Ending July 30, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.39 per gram this week, down 2.2% from last week’s C$5.51 per gram. This week’s price equates to US$1,953 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

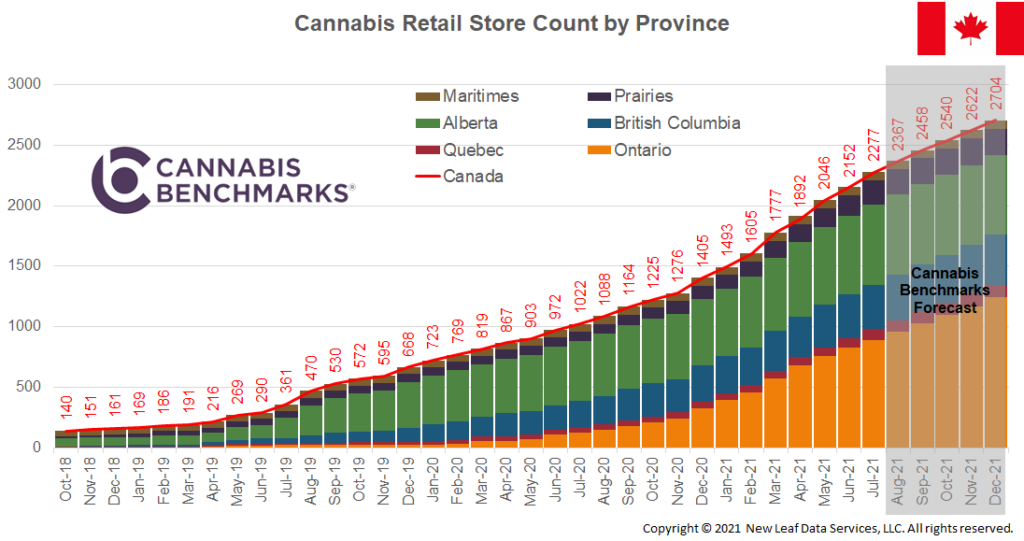

This week we review Canada’s recreational cannabis store count. The number of stores continues to climb steadily across the country, making the legal cannabis system more accessible to consumers. Our latest count shows the number of stores open for business reached 2,277 as of the end of July. This is up by 1,255 stores, or a jump of 123%, compared to July 2020. As can be seen in the chart below, we expect that trend to continue throughout this year.

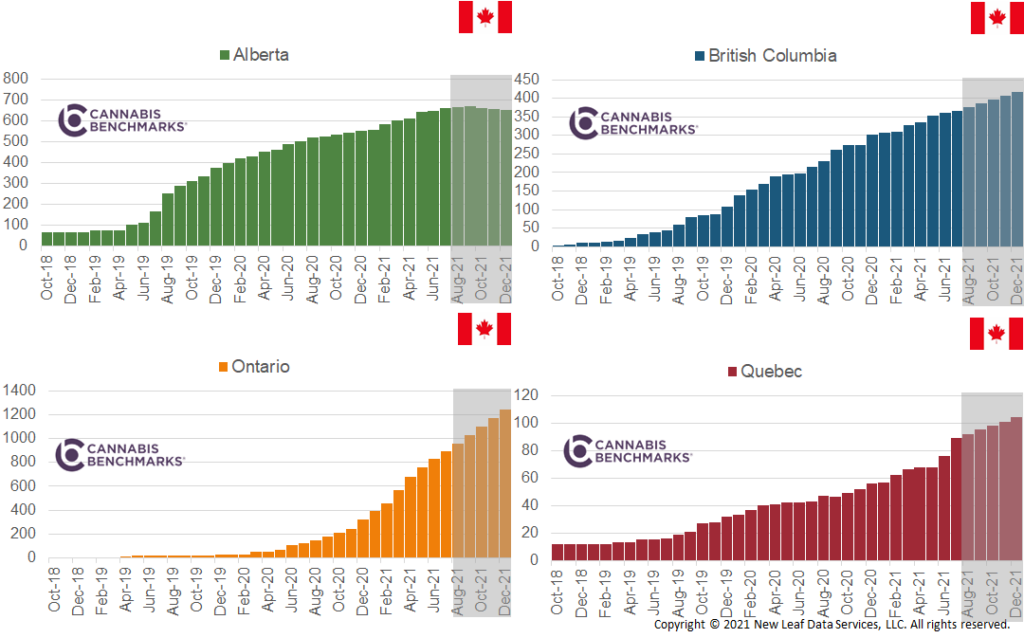

With each province having different licensing processes, we see different growth rates.

We expected Alberta’s store count to plateau in the second quarter of this year, but the store count there has continued to grow. We do not expect additional new store growth and anticipate some stores will close before the end of the year due to strong competition with other closely-located stores in major cities. British Columbia (BC) has increased its store count at a steady pace in 2021 so far and we expect that growth to continue through the end of the year. At the moment, the BC government reports 25 stores in the queue that are licensed and ready to open. We anticipate approximately 10 stores will open in BC each month through the rest of 2021.

In Quebec and most of the Maritime provinces, provincial governments control the retail sector, with each province owning both the distribution and retail parts of the supply chain. The rollout has been relatively slow with the provinces in control. In June and July, however, the pace picked up in Quebec, a trend which we project will continue throughout the year. Quebec currently has 89 cannabis retail locations, which is a 106% increase from last year, and we expect the store count there will expand to 104 retail locations by the end of the year. The rising store count should drive significant growth in retail sales revenue across the province for 2021.

Ontario continues to be the biggest driving force for new cannabis retail stores. After the slowest initial rollout of licensed stores among all provinces, it now has a target of 1,000 stores by September 2021. Ontario store counts are not fully visible, as the provincial government there reports the number of stores that are “Authorized to Open.” The Ontario Cannabis Store website also has provided a store locator tool, but this store count is usually substantially lower than the actual figure. We estimate that 891 stores are currently open in Ontario, a figure we expect to increase to 1,241 by the end of the year.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.