The Enterprise Subscription/Solution gives the cannabis industry professional the ability to perform in-depth modeling and analysis utilizing granular pricing and fundamental data sets that Cannabis Benchmarks has been developing over the past 8 years.

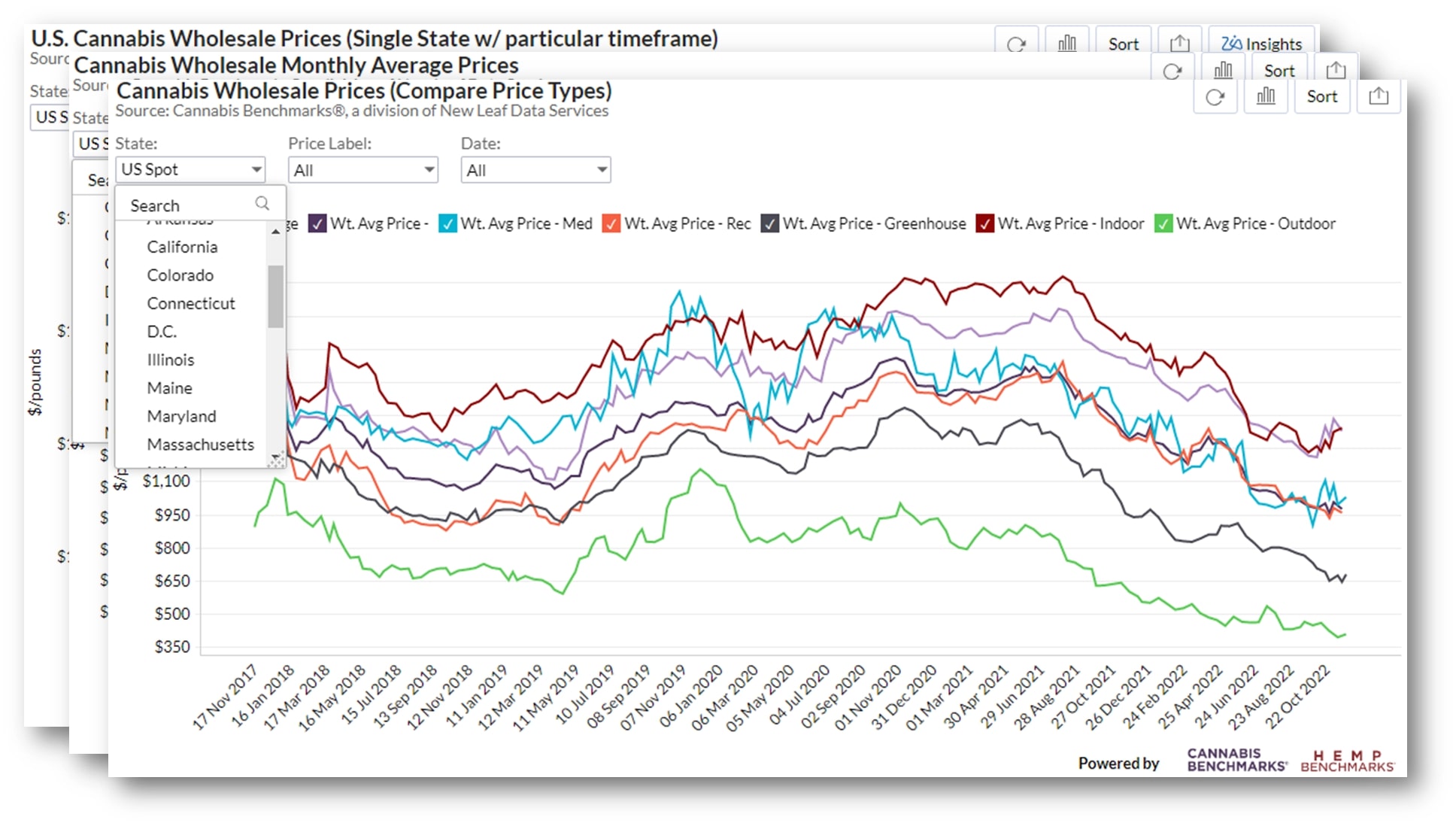

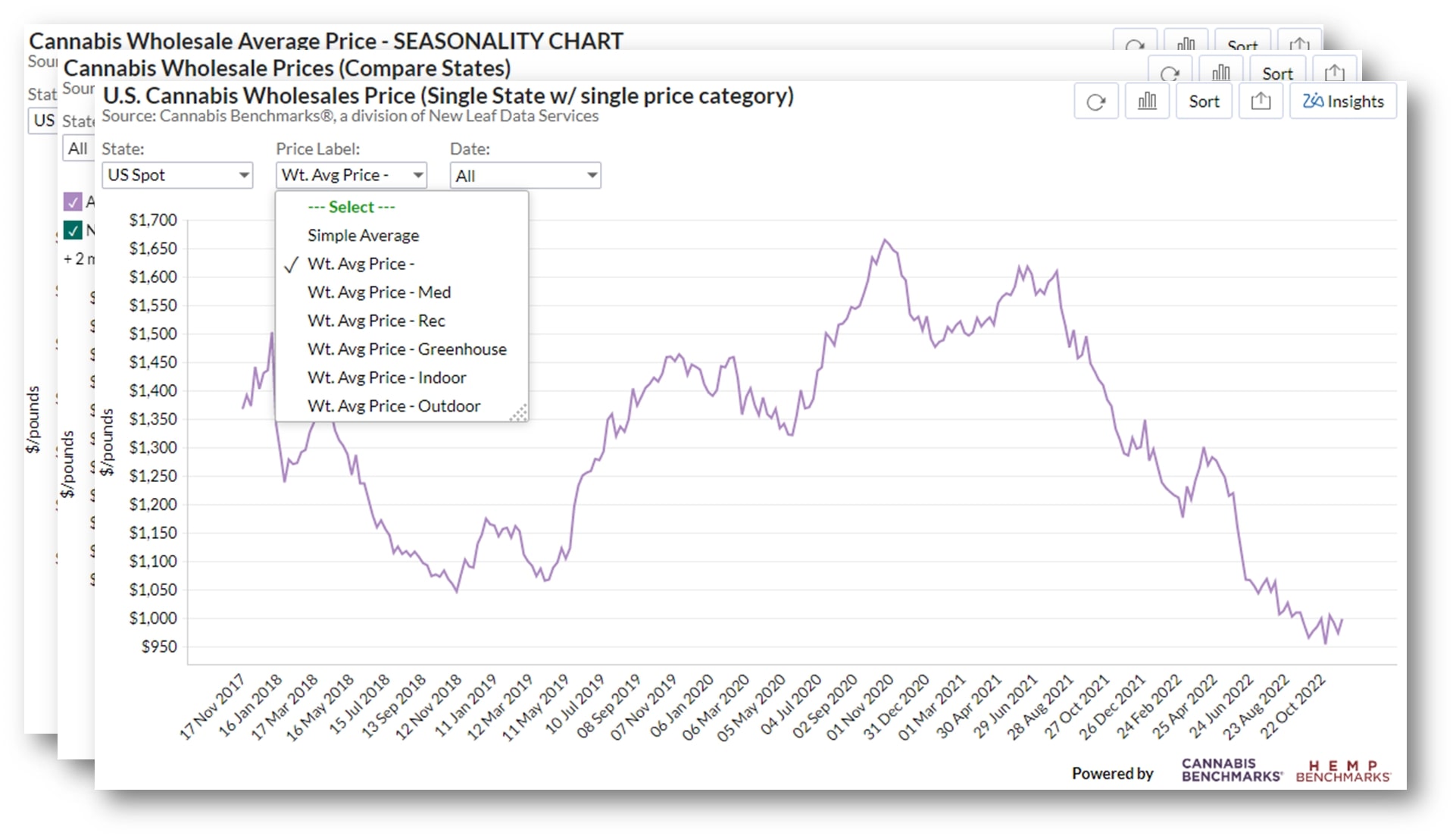

Our weekly price assessments include data points for the US aggregate and 19 State Markets. Available data points include volume weighted averages and simple averages for each geography and cultivation method (e.g. Indoor, Greenhouse, and Outdoor). Additional data points can be generated upon request.

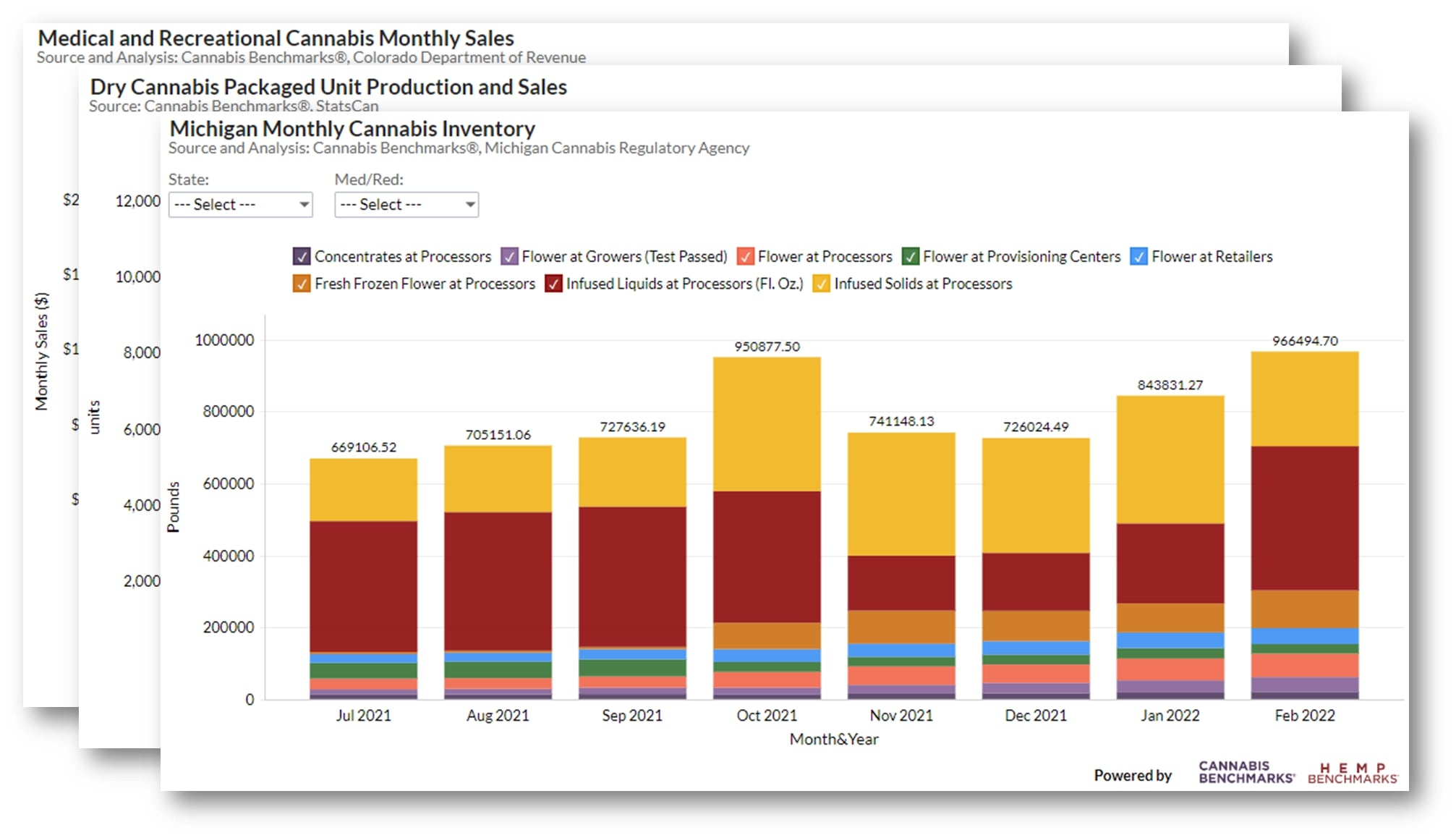

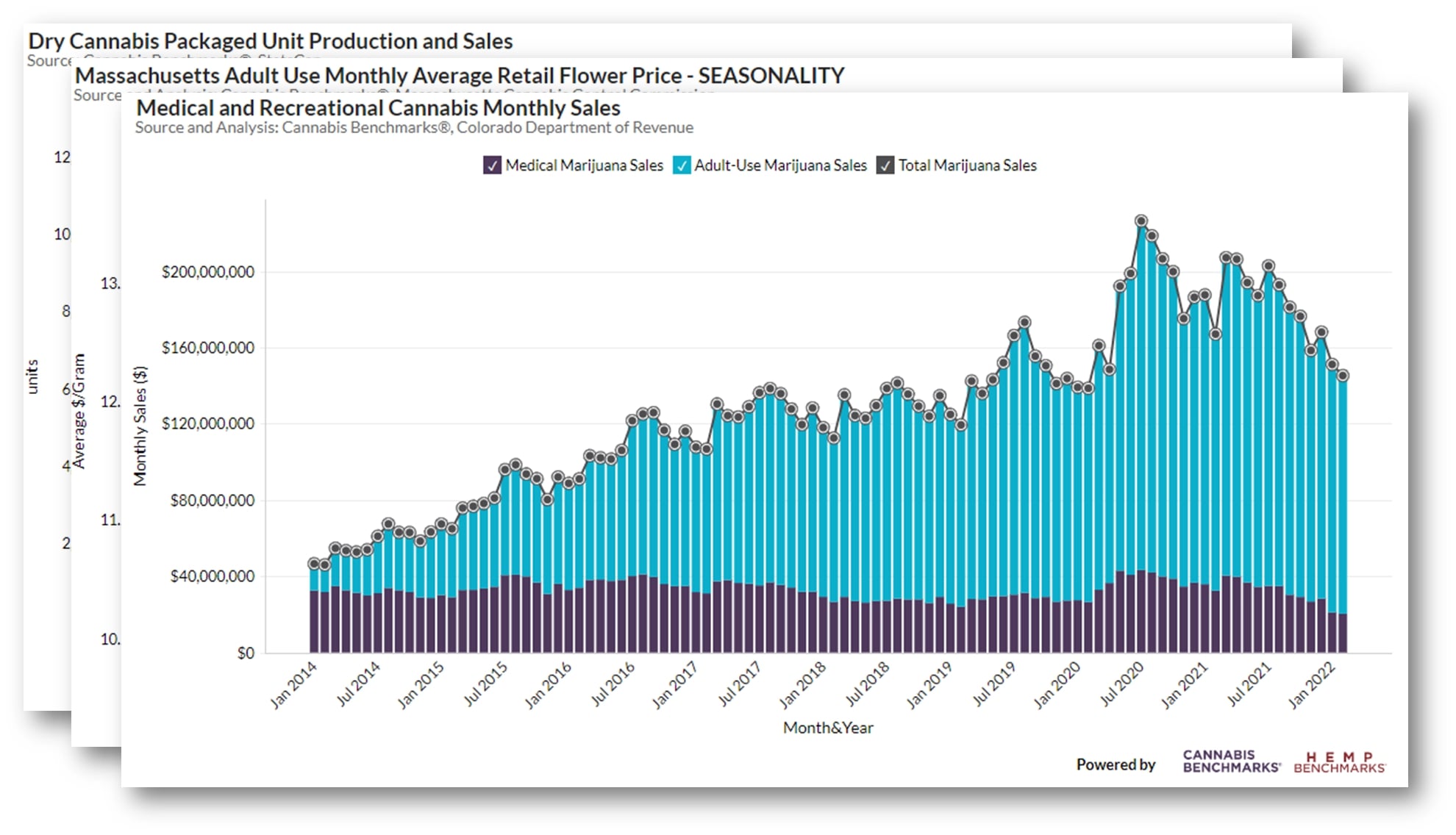

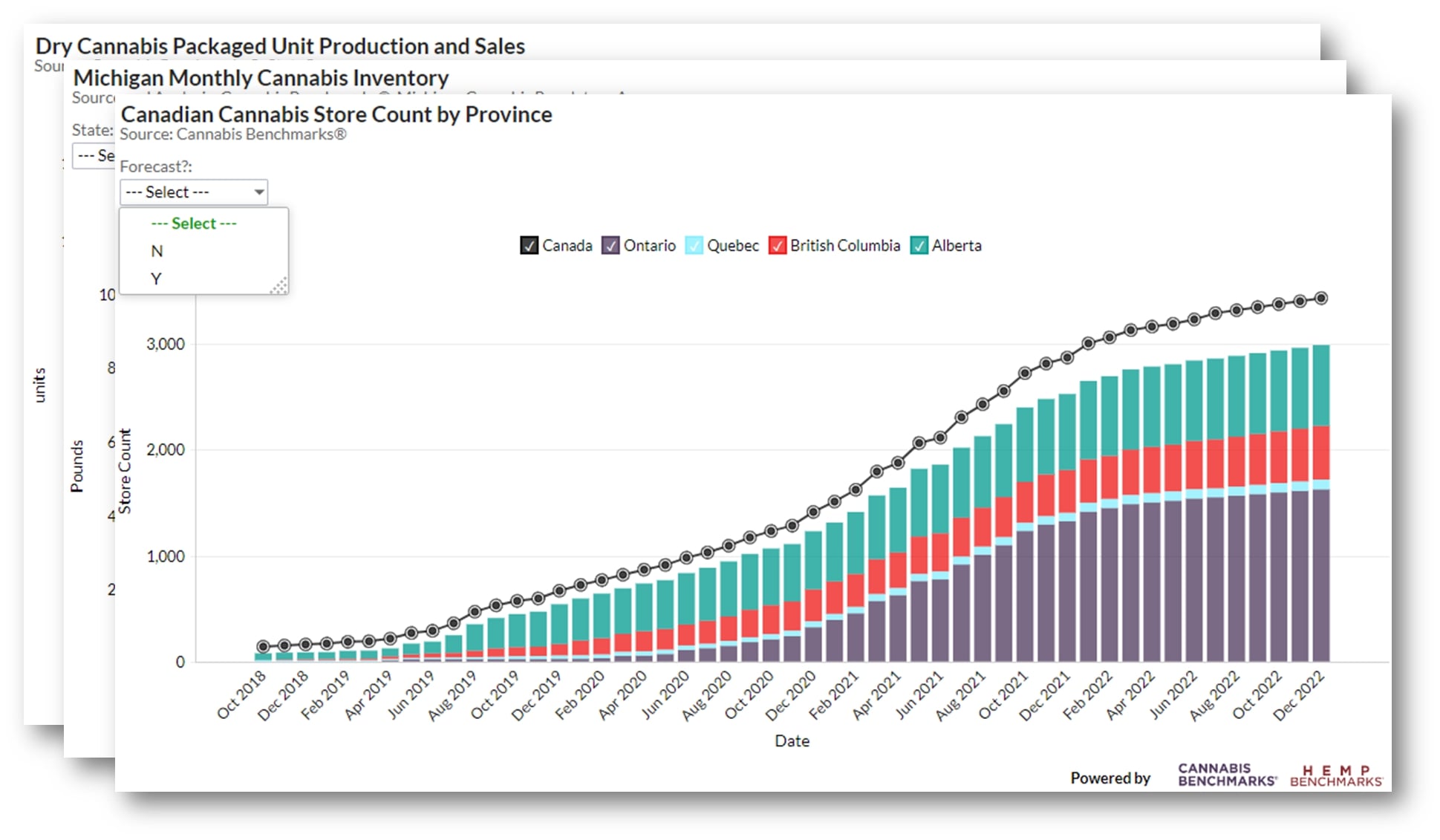

We track all available supply, demand, sales & inventory data made available through state cannabis agencies.

We track all available supply, demand, sales & inventory data made available through state cannabis agencies.

Buyers & Sellers

Use price benchmarks to set prices and transact with confidence.

Crop Insurers

Use wholesale cannabis prices and yield analysis to build actuarial tables to determine crop insurance premiums.

Accountants

Use cannabis prices by type of grow to determine an asset’s value for an acquisition or divestiture. Additionally, market prices are used in preparing financial statements and tax returns, for example, in determining the value of inventory, as well as trade-related mark-to-market / fair value accounting.

Debt & Equity Analysts

Rating a bond or stock can use the most applicable spot and forward prices (and the history) to evaluate the likelihood that a company can make interest payments or grow earnings per share.

Investors/Funds

Can use the price streams to evaluate and compare competing investment opportunities (e.g., what’s a better investment, an indoor grow in Illinois or a greenhouse grown in Michigan?).

Operators

Cultivation facilities and dispensaries looking to grow can determine the best investment: expansion of a current facility in one location or opening a second facility in a different location.

Hedge Funds

Can use the different price streams to optimize their portfolio of cannabis businesses, as well as implement trading and risk management programs using the spreads and correlations among and between different commodities and financial instruments. Additionally, they use price benchmarks to index and settle both physical and financial transactions.

Risk Managers

Use commodity prices to measure, report and manage a firm’s risk, for example, a hedge fund or trader’s Cash Flow at Risk (CFaR), or Earnings at Risk (EaR), as well as to comply with a variety of required filings, including mark-to-market / fair value accounting.

Speculative/Futures Traders

Use the prices, spreads and correlations among and between different commodities and financial instruments to develop proprietary trading algorithms which could incorporate cannabis prices, even if they are trading soybeans, weather derivatives, bonds in farm equipment companies, or equities in fertilizer companies. Additionally, they use price benchmarks to index and settle financial transactions.

"*" indicates required fields