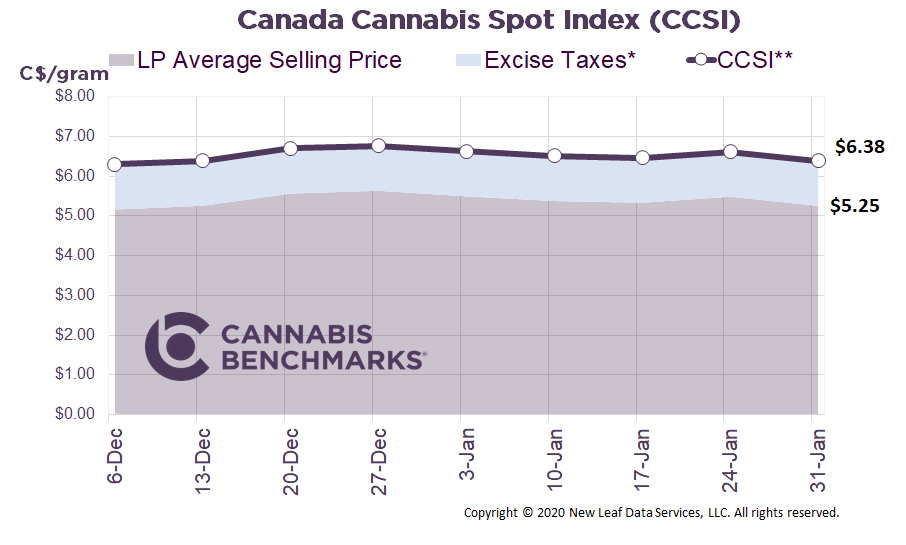

Canada Cannabis Spot Index (CCSI)

Published January 31, 2020

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.38 per gram this week, down 3.5% from last week’s C$6.61 per gram. This week’s price equates to US$2,209 per pound at the current exchange rate.

This week we examine new retail cannabis sales data reported by Statistics Canada. Last week, November 2019 sales were published. Canadian legal cannabis sales amounted to C$135M in November, up by 5.2% from October’s sales total. Despite showing some overall expansion from the prior month, digging into the numbers it is clear that all the sales growth came from one province – British Columbia (BC).

BC looks to be playing a bit of catch up, and the sales increase blew past our modelled expectations. This is a positive sign for the legal industry, because BC is regarded as one of the provinces with the strongest illicit market presence. The sales growth can be attributed to an exponential expansion in physical stores across the province. BC sales in November 2018 were only C$1.1M; November 2019’s sales of C$19M shows 1,666% growth over the year.

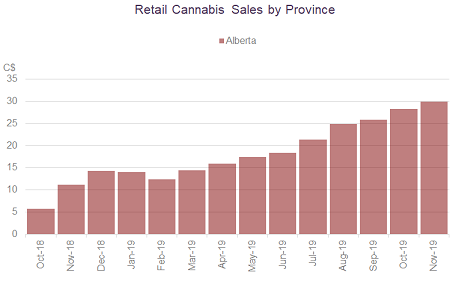

Source: Cannabis Benchmarks

Alberta retail cannabis sales have climbed steadily since legalization. As we reported last week, Alberta has been seen as the most liberal and forward-looking province for making legal cannabis available to users. The Alberta government’s framework to license and regulate cannabis retailers has been simple and quick; hence has been more successful that other provinces in stamping out the illicit market. Alberta sales in November 2018 were C$11.2M, November 2019’s sales of C$29.8 represent a rise of 166% year-over-year.

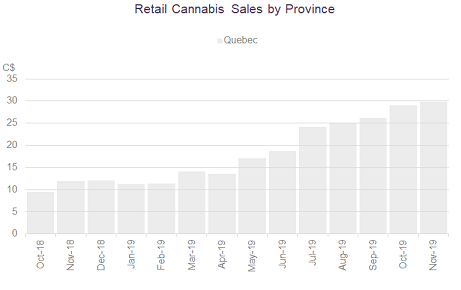

Quebec has been another province that has successfully grown sales over the first year of legalization. Quebec’s goal since initiation was to keep taxes and prices low to beat out the black market. Quebec sales in November 2018 were C$11.9M in total; November 2019’s C$29.8 in sales constitutes an increase of 151% over the year.

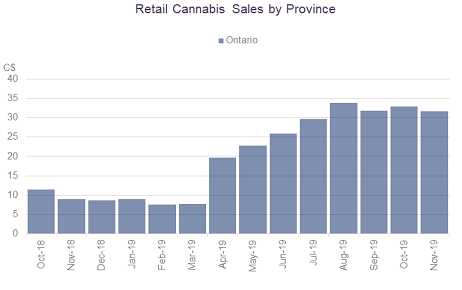

Lastly, we turn to Ontario. Ontario, Canada’s most populous province, receives a lot of attention from cannabis investors. In fact, most LPs blamed the sluggish roll out of retail stores in Ontario as the major reason for their lagging financial performance. Ontario’s slow roll out of retail shops (there are only 25 in the province currently) has hurt overall cannabis sales and kept customers going back to the illegal sources. As seen in the chart below, sales were very low until April 2019, with cannabis only offered through the online Ontario Cannabis Store prior to that month. After April 2019, sales climbed steadily as the current stores opened, but growth stalled in late summer. With the Ontario government facing immense pressure they have abandoned the lottery system for awarding new retail licenses, but the impact of more easily obtained stores licenses and sales is not expected until early Q2. Ontario sales in November 2018 were C$8.9M; November 2019 sales of C$31.6 show a rise of 254% from a year ago.

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.