Canada Cannabis Spot Index (CCSI)

Week Ending March 5, 2021

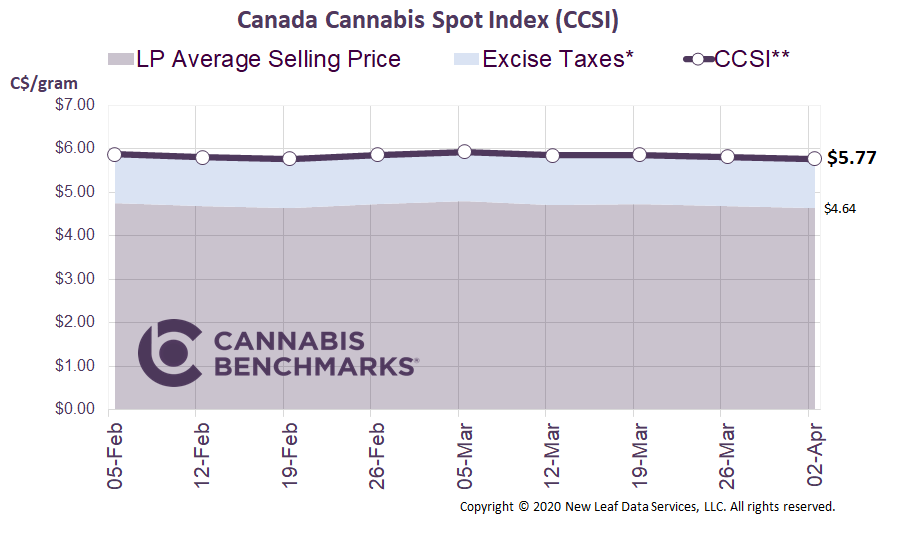

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.93 per gram this week, up 1.2% from last week’s C$5.86 per gram. This week’s price equates to US$2,126 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week, we review Canada’s recreational cannabis store count. The number of stores continues to climb steadily across the country, making the legal cannabis system more accessible to consumers. Our latest count shows the number of open stores reached 1,484 as of the end of February. This is up by 742 stores, or 96%, compared to February 2020. As can be seen in the chart below, we expect the trend to continue this year.

With each province having different licensing processes, we see different growth rates.

Source: Cannabis Benchmarks

Of the top four provinces, Alberta seems to have reached its limit, at least momentarily. We do not expect much more growth there and, in fact, expect some stores to close due to strong competition. British Columbia (BC) increased its store count at a steady pace in 2020, but we expect the growth rate to slow in 2021. At the moment, the BC government only reports 25 stores in the queue that are licensed and ready to open. We anticipate approximately 10 stores to open in BC each month through 2021.

In Quebec, along with most of the Maritime provinces, the provincial government controls the retail environment, with the province owning both the distribution and retail parts of the supply chain. With the province in control, the rollout has been quite slow. Quebec currently has 62 cannabis retail locations and we anticipate that will grow at a pace of only three new stores per month this year.

Ontario continues to be the biggest driving force for new cannabis retail stores. Ontario had the slowest initial rollout of licensed stores among all provinces, but that has drastically changed since Q2 2020. The speed at which new stores are opening for business is helping drive strong sales growth in the province, a trend that looks as if it will persist for the foreseeable future. Based only on current applications in the pipeline, it appears that Ontario’s retail rollout will continue at a strong pace in 2021. We anticipate an average of 65 stores opening per month in the province throughout this year.

Overall, the current year looks bright for the Canadian cannabis industry. We see substantial, strong growth of the country’s legal market continuing, providing an example for the increasing number of U.S. states contemplating legalization, as well as America’s federal government.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.