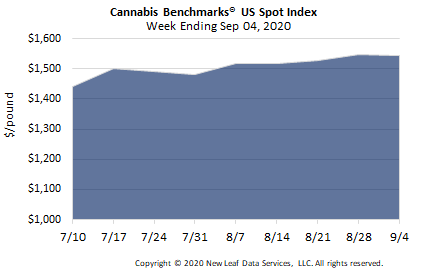

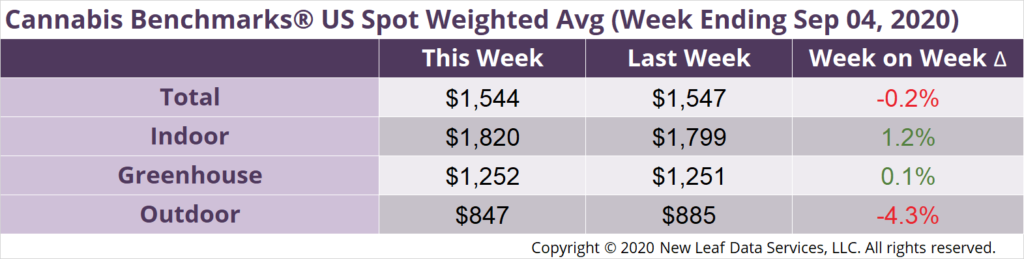

U.S. Cannabis Spot Index down 0.2% to $1,544 per pound.

The simple average (non-volume weighted) price increased $36 to $1,798 per pound, with 68% of transactions (one standard deviation) in the $985 to $2,611 per pound range. The average reported deal size increased to 2.3 pounds. In grams, the Spot price was $3.40 and the simple average price was $3.96.

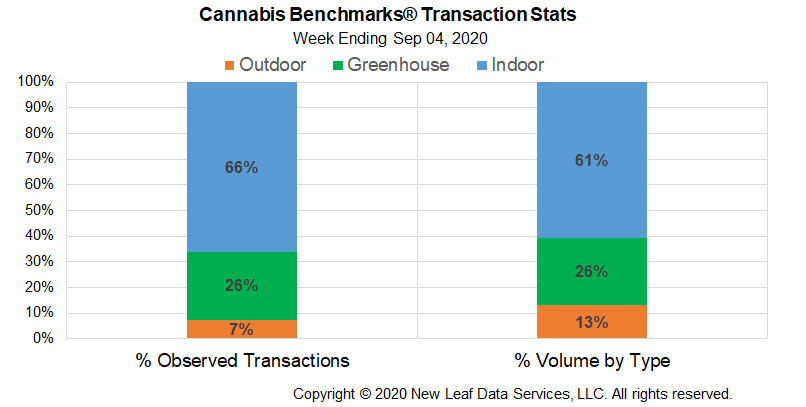

The relative frequency of trades for outdoor flower decreased by over 3% this week. The relative frequencies of transactions for indoor and greenhouse product increased by about 2% and 1%, respectively.

The relative volume of warehouse product contracted by 2%. The relative volume of greenhouse flower expanded by the same proportion, while that for outdoor product was unchanged.

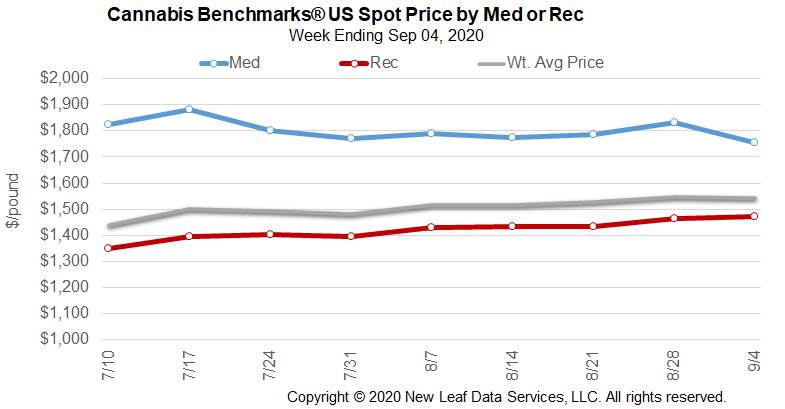

After falling to its current year-to-date low of $1,322 per pound in late May, the U.S. Spot Index rose by 17% over the roughly three months from that point to the final week of August. The first official August sales figures from a sizable legal cannabis market were released this week by Massachusetts, which showed revenue in the state’s adult-use sector reaching a new record high for the second straight month. Meanwhile, newly-published June sales from Nevada officials show total retail revenue returning to pre-COVID levels, despite tourism to Las Vegas remaining extremely depressed relative to prior to the pandemic.

These early signs suggest that August sales in other state markets may have continued to set records, or at least remain elevated with only small declines. August is typically one of, if not the strongest sales month of the year, particularly in adult-use systems. However, with unprecedented sales since the spring, in addition to the expiration of expanded unemployment benefits for millions of Americans at the end of July, there were questions as to whether the outsized demand that has marked the April through July period would hold. The upcoming Labor Day weekend is also typically a strong sales occasion for legal cannabis retailers.

While the fall outdoor crop will begin to be harvested in the coming weeks and months, last year’s data indicates that immediate price declines may not be in the cards even with the production of significant new supply. In 2019, the U.S. Spot rose through most of Q3 to reach its annual peak in mid-November.

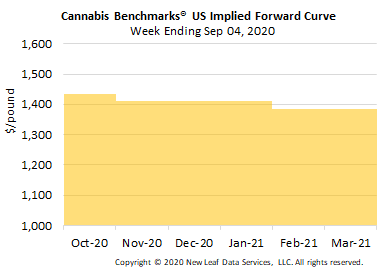

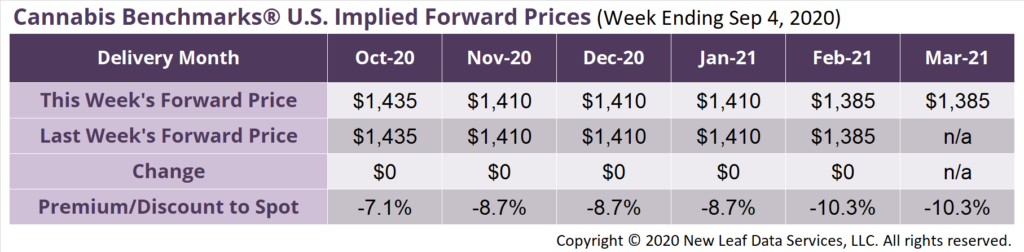

March 2021 Forward initially assessed at $1,385 per pound.

The average reported forward deal size was 28 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 39%, 34%, and 27% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 30 pounds, 25 pounds, and 30 pounds, respectively.

At $1,435 per pound, the October Forward represents a discount of 7.1% relative to the current U.S. Spot Price of $1,544 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Tax Collections from Santa Barbara County Cultivators Spike as Strong Retail Demand Inflates Producer Sales and More Growers Come Online

Nevada

June Sales Rise to Pre-COVID Levels Even as Las Vegas Tourism Remains Significantly Lower than Normal

Massachusetts

August Adult-Use Sales Approach $79 Million, Setting a New Record for the Second Straight Month

Illinois

Medical Cannabis Sales Subside by 5% in August After Setting Record in July

Maine

Guidance from Regulators Details How Plants to Supply Adult-Use Market May Be Transferred from Medical System