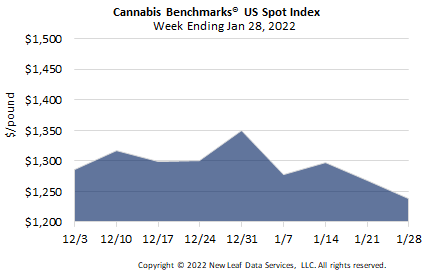

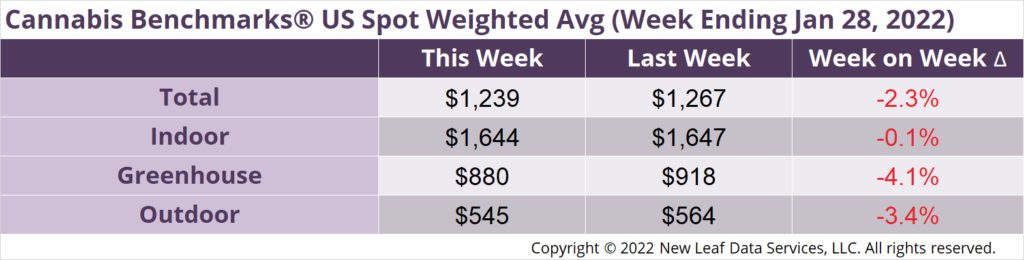

The U.S. Cannabis Spot Index decreased 2.3% to $1,239 per pound.

The simple average (non-volume weighted) price increased $6 to $1,551 per pound, with 68% of transactions (one standard deviation) in the $718 to $2,384 per pound range. The average reported deal size increased to 2.4 pounds. In grams, the Spot price was $2.73 and the simple average price was $3.42.

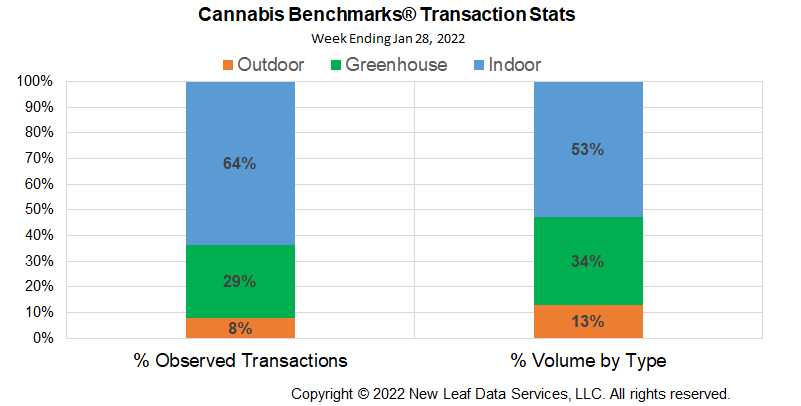

The relative frequency of transactions for indoor product rose 2%, that for deals for greenhouse product fell 2% and outdoor transactions rose 1%.

The relative volume of indoor flower was unchanged, while that of greenhouse flower fell 1% and outdoor flower relative volume rose 2%.

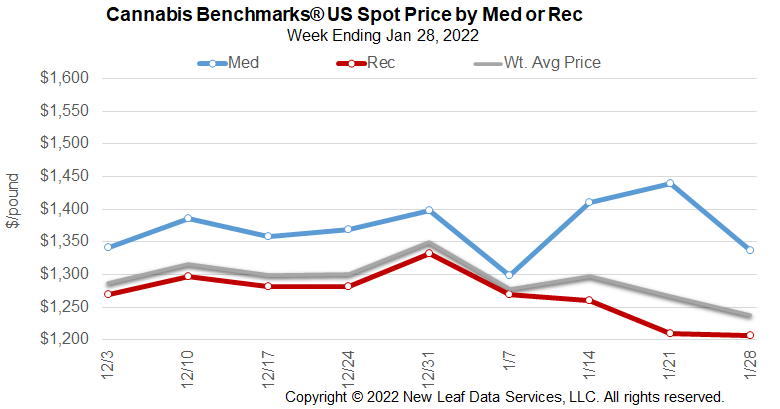

U.S. Spot prices continue to spiral downward with price contagion from the largest crop, outdoor flower, spreading up to other grow types. Price contagion occurs when similar, but not necessarily identical markets are perceived to be all one market by buyers and, to some extent, sellers. In short, cannabis is all one crop, for all the differentiation between grow types.

The current price contagion in cannabis markets began in earnest in the second half of 2021, as a result of significant oversupply in mature western markets. Additionally, the effective disappearance of differentiation amongst outdoor-grown product due to the emergence of single buyer type dominating the market – extractors – has played a significant role. Growing demand for extracted products has resulted in more extractors taking in more raw plant material and businesses will always seek the most efficient (least expensive) inputs to create products. From the grower perspective, increasing canopy is the immediate answer to falling prices, without regard for consumer demand.

Indoor, greenhouse, and light deprivation products will likely seek higher levels of differentiation to push back against price contagion. However, the lengthy process of differentiation – the cost in time and money – likely means a small percentage will succeed in these efforts at first. Indeed, in Oregon, sources have told Cannabis Benchmarks that a small number of indoor cultivators have successfully distinguished their products and command premium prices, while the majority of growers struggle with wholesale price erosion. Ultimately, cannabis businesses that succeed in marketing themselves as different and superior will hold more value.

There is a movement afoot across several states to re-examine various aspects of legal cannabis regulatory schemes. Oregon previously put in place a moratorium on cultivation licenses and Oklahoma lawmakers are exploring a moratorium on virtually all license types. In fact, Oregon may place yet another moratorium on cultivation and retail licenses in an effort to slow the significant price erosion in the state. In California, growers are seeking temporary and permanent tax relief on the state and local level with some success. All of these efforts will take time, during which price will likely continue along the path of least resistance – down. That said, efforts along these lines, and eventually full federal legalization, have the potential to reverse current price trends in the most economic way possible, by increasing demand.

Legacy state price changes week-on-week are: Washington State, -2.1% per pound; Oregon, -3.1%; Colorado, -0.6%; and California, -5%.

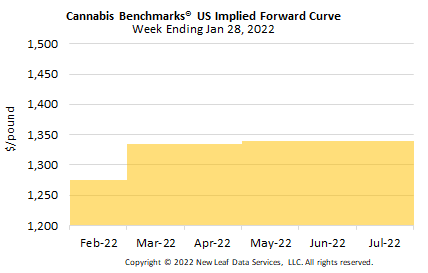

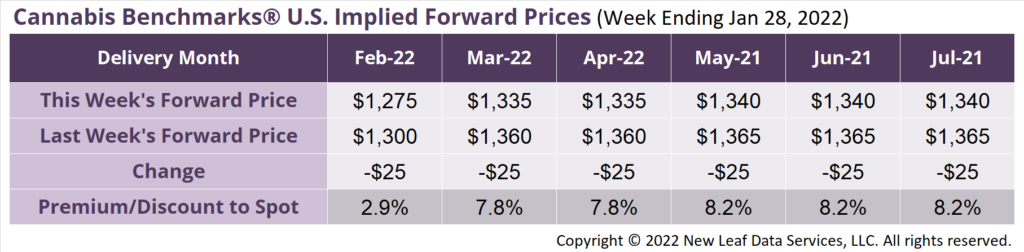

February 2022 Implied Forward assessed down $25 to close at $1,275 per pound.

The average reported forward deal size was 59 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were unchanged at 37%, 49%, and 15% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 77 pounds, 51 pounds, and 42 pounds, respectively.

At $1,275 per pound, the February 2022 Implied Forward represents a premium of 2.9% relative to the current U.S. Spot Price of $1,239 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Humboldt Revolt: Growers Seek Local Cultivation Tax Repeal

Oklahoma

Legislators Propose Two Year Cannabis License Moratorium

New York

State Projects $1.5 Billion in Cannabis Taxes Over Six Years